And, perhaps most importantly, an accountant can help you structure your financial affairs so that you get the most money from selling your business. Depending on how the sale is structured, the amount of money you receive after tax can vary considerably. For example, a lump sum might be less tax-efficient than monthly payments over a period of years. This makes it easier for you and the government to see exactly what transactions have taken place over time – and who authorized them.

The purpose of tax planning is to mitigate your tax liabilities while developing a tax-efficient financial strategy for retirement and making investments. This free cloud-based platform also lets you track your personal finances as well as pay your bills online. It syncs with your bank account to simplify your personal finances.

CPAs must also perform continuing education on a yearly basis in order to maintain their knowledge of best-practice accounting standards. While CPAs and accountants perform similar tasks, there are multiple differences in the functions they perform. Although there are many avenues you can take with an accounting major, Conticchio recommends “gaining experience in the branch you feel confident,” either through internships or interdepartmental moves.

Audit insurance covers the fees you would have had to pay if your business needed to respond to an official enquiry, review, investigation or audit by a tax department. An accountant who offers audit insurance means they won’t charge any extra for the considerable amount of work they’ll have to carry out during the audit process. If you involve an accountant while you’re writing your business plan, they will be able to use accounting software to add financial projections and other reports to it. This will help you create a business plan that’s realistic, professional and more likely to succeed.

Our 300-acre campus in Manchester, NH is home to over 3,000 students, and we serve over 135,000 students online. Visit our about SNHU page to learn more about our mission, accreditations, leadership team, national recognitions and awards. Betty Egan is a freelance copywriter with 25+ years of experience across a diverse spectrum of industry sectors, including higher education.

Do I Need a Personal Accountant?

They can also help ensure you don’t violate any tax laws afterwards – because the government will almost certainly be watching. For 71% of small and medium business owners, cash flow problems are one of the leading causes of concern for their operation. This article will explore how accountants can lend a helping hand to leaders to get the most out of their business through efficient cash flow management. It depends on your situation, but accountants bring a lot more to the table than just filing taxes and handling paperwork. An accountant can analyze your business’s financial data which may show you how to make your business more profitable.

For example, they can check whether the company’s assets (like equipment) are fully owned or leased or part-paid for, and whether the company has any outstanding debt. Make data-driven decisions to drive reader engagement, subscriptions, and campaigns. Alyssa Gregory is an entrepreneur, writer, and marketer with 20 years of experience in the business world.

Ways An Accountant Can Help A Small Business Owner

Read more on what accountants have to do with the EU agenda in the first blog of our sustainable finance series. I know tax issues need to be handled immediately which is why I’m available 24/7. We help our clients stay out of trouble with the IRS and stay in compliance with U.S. tax laws. Connect payroll, tax solutions, and 3rd-party apps to accelerate and enrich your work. Self-paced lessons help grow your knowledge and skills to advise your clients. Connect with other pros and small business owners to get answers, ideas, and inspiration.

- They can also help you network with other small business owners, potential partners, and customers.

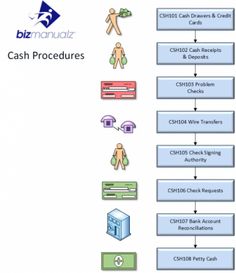

- To run an effective organisation, executives must understand the incoming and outgoing cash flow, including cash receipts, operating expenses, and sales volumes.

- If your adjusted gross income for 2022 was $73,000 or less, be sure to check out the IRS’s Free File program, where you can access tax software from several brand-name providers for free.

- A professional accountant can help you create and maintain a cash flow statement, a budget, and a forecast.

Even if the IRS reaches out asking for something as simple as substantiation of expenses related to a car you bought, Kohler recommends looping in a professional. “But, if you handle it incorrectly, Accountant help it can turn into a big deal quickly.” If businesses want to keep thriving, they need to adapt their strategies towards long term success in financial and non-financial terms.

Get an accountant’s advice before you buy a business

Once you’ve handed over your company’s finances to someone more experienced in accountancy than you are, you will have more time to concentrate on other aspects of your business. There are good reasons for hiring an accountant at different stages of your company’s growth. From a business plan to company formation, loan application to tax audit, an accountant can make life easier for you at each step. Sanay is a full-service finance partner ready to help you grow your business to achieve its full potential.

- If you’re just an individual filling out a W-2, you can likely handle that yourself.

- Our partners cannot pay us to guarantee favorable reviews of their products or services.

- Accountants can also guide your small business in more profitable directions, giving you “the biggest tax bang for your buck,” Cordano said.

- If you are starting a small business on a limited budget, you might not want to spend the money to hire an accountant.

- They include the income statement, the balance sheet, and the statement of cash flows.

“(Take) it one day at a time and one doable task at a time,” she said. “Give yourself grace when learning something new in any environment.” This website is using a security service to protect itself from online attacks. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. Where you can access tax software from several brand-name providers for free. Aside from vetting a tax preparer, there are some other considerations to keep in mind when looking for tax help.

Technical Requirements

“It took me about four and a half years to get my master’s because I was working full-time as a teacher,” Conticchio said. “Because of my demanding schedule, I could only manage one class at a time. “It’s very important for accountants to be able to effectively communicate and work with non-accountants,” she said.

She lives and works remotely from the mountains of northern New Hampshire. She also looked to one of her advisors at SNHU, who encouraged her to identify the transferrable skills gained in her teaching career and seek out entry-level jobs to get her start in accounting. The best accountants also possess a strong work ethic, attention to detail, excellent organizational skills and a knack for solving problems. If your ultimate goal is to work in a field indirectly related to accounting, an accounting degree can help you get there. As for Stephens, she joined the field as a county auditor before moving into local government, where she spent 25 years.

Open a Separate Business Bank Account

Your bookkeeper will schedule regular appointments (e.g., weekly, monthly) to input data and perform the tasks you want to be done. Bookkeeping may be done in person (your home or the bookkeeper’s office) or online. Either way, you’ll need to provide access to your bank accounts and credit card statements, so be sure to check the references carefully of anyone you want to engage. An accountant can also use accounting software to analyze your cash flow, inventory management and pricing. They can also provide insight into how to properly grow your business through financial analysis. They could even help determine when is the best time to introduce a new product or service offering to your range.

CPAs are uniquely qualified to work in public accounting firms, which serve multiple clients across industries. These clients may be companies, governments or individuals, depending on the size and type of accounting firm. CPAs are licensed professionals, which requires them to adhere to more stringent standards than unlicensed accountants. Both of these paths are viable long-term career options for aspiring accounting professionals. Let’s dive deeper into the differences so you can choose which path is right for you. “SNHU provided me with the education and experience I needed to transfer knowledge to the real working environment,” Conticchio said.

Running a business is complicated for any leader, and financial pressure can quickly mount up without a healthy cash flow. One in seven SMEs has experienced a crisis in cash flow that left them unable to pay their employees. A well-versed accountant can help organisations to create meaningful profits while maintaining an in-depth financial forecast so businesses can make better choices in the long run. Accountants can help ensure that invoices are issued on time so payments can be received quickly, reducing crucial delays.

They need to identify where they create or destroy value and adapt their strategies accordingly. The US considers Saudi Arabia a combat zone for military personnel and qualified civilians. Tax reporting for individuals working there requires specialized knowledge. Make sure you receive proper benefits for putting your life at risk. I’m a CPA with experience in combat zone designations, hypothetical tax, and tax equalization.

After living in Saudi Arabia, Korea, and Japan, Ted became aware first-hand of the challenges that complying with U.S. tax law can present when living abroad. Now that Ted has returned to Oregon, he devotes his practice providing tax services to expatriates in those countries and around the world. They tended to choose their accountants for advice over everyone else (including their attorneys, financial planners and family members). If you and your accountant use cloud-based accounting software, you’ll be able to keep track of what your accountant does, and always be able to see your company’s financial situation at a glance. If you don’t already have an accountant at this point, it’s a good time to hire one. They can give you advice on how to work within the auditing process.

Top AI Tools for Accounting 2023 – MarkTechPost

Top AI Tools for Accounting 2023.

Posted: Fri, 04 Aug 2023 07:00:00 GMT [source]

You can hire an accountant during the start-up phase and have them handle your annual reporting, but work with a bookkeeper to manage your books on a regular basis. If you run a small business, have a tricky tax year, are a new investor or just want to talk with a person face to face, working with a tax preparer or another tax professional may be worth it. If your tax return is simple, an RTRP is fine, but if you need someone who can handle more complexity, hiring a CPA might be smart. If you or your business has been chosen for a tax audit, CPA Ted Kleinman is ready to provide comprehensive audit defense services. He will prepare you for what to expect, deal with IRS auditors and requests for documentation on your behalf, and protect your legal rights as a taxpayer throughout every stage of the audit process. Recording your income and expenses isn’t a difficult task (you don’t need an accounting background or to be “good with numbers”), but it does take time and effort.

Recent Comments